Canara Bank is one of the leading public sector banks and now caters to a wide range of customers after Syndicate Bank was merged with it. The merger of both banks led to the unification of some similar plans as well and one of them was the Pigmy Deposit Scheme of Syndicate Bank. “With effect from 01.04.2020, Pigmy Deposit Scheme of erstwhile Syndicate Bank and New Nitya Nidhi Deposit (NNND) Scheme of Canara Bank is merged and renamed as NITYA NIDHI DEPOSIT (NND) Scheme,” said the Canara Bank.

Canara Bank Nitya Nidhi Scheme is aimed to mop up small savings and is specially designed for daily savers of small means and based on daily door collection. If you open this account, you are not required to visit the bank for cash deposits as the bank’s Authorized agent will collect your savings at your doorsteps at daily or less frequent intervals in tune with your convenience.

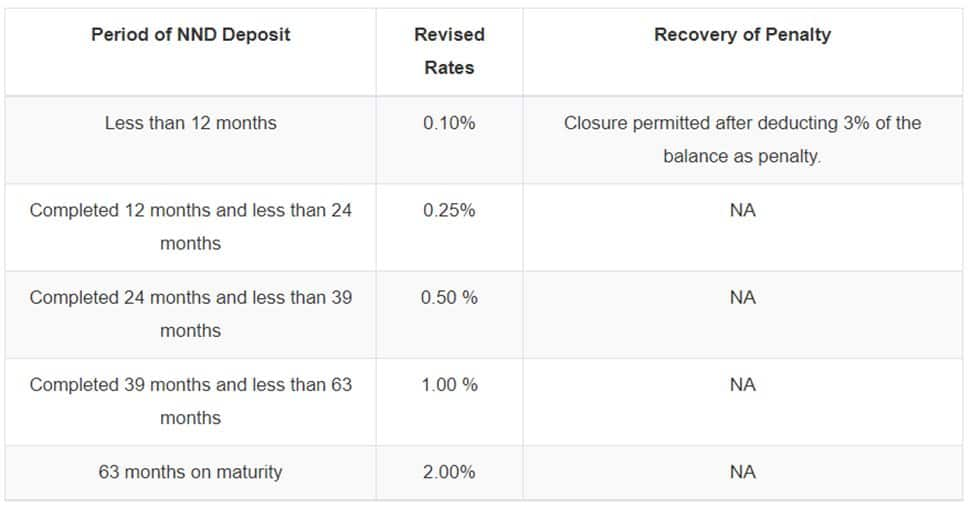

Canara Bank Nitya Nidhi Scheme Interest Rates: The deposits made into Canara Bank Nitya Nidhi Scheme accounts earn interest at the rate of 2 per cent at maturity. The maturity period is 63 months or five years or three months. The minimum collection amount is Rs 50 and the maximum limit on daily collection is Rs 1000 (Maximum Rs 30000 in a month). The interest rate varies if the deposit is withdrawn before maturity. A 3 per cent penalty is imposed in case of pre-closure of the account within 12 months. No penalty is levied if the account is more than a year old.

Canara Bank Nitya Nidhi Scheme Loan Facility: The scheme also offers a loan facility for account holders as they can get a loan of up to 75% of the outstanding balance. A nomination facility is also available in the scheme.