Globally, power systems are undergoing a pivotal phase of development. The exponential surge in renewable energy installations within the past decade has exposed the grid infrastructure to increased risks arising from the variable nature of renewable energy, especially from solar and wind.

Since solar and wind power supply fluctuates, energy storage systems (ESS) play a crucial role in smoothening out this intermittency and enabling a continuous supply of energy when needed. Thus, for sustainable renewable energy addition, concurrent growth of ESS capacity is imperative.

Battery-based ESS (BESS) and pumped hydro storage (PHS) are the most widespread and commercially viable means for implementing energy storage solutions.

The Central Electricity Authority’s (CEA) latest optimal generation mix report indicates that India will need at least 41.7 gigawatt (GW)/208.3 gigawatt-hour (GWh) of BESS and 18.9GW of PHS in the fiscal year (FY) 2029-30.

Akin to the growth of renewable energy, large grid-scale tendering will play a crucial role in developing the ESS market in India. As of November 2023, more than 8GW of ESS tenders have been awarded in India, with more than 60% of this capacity allocated in 2023 alone.

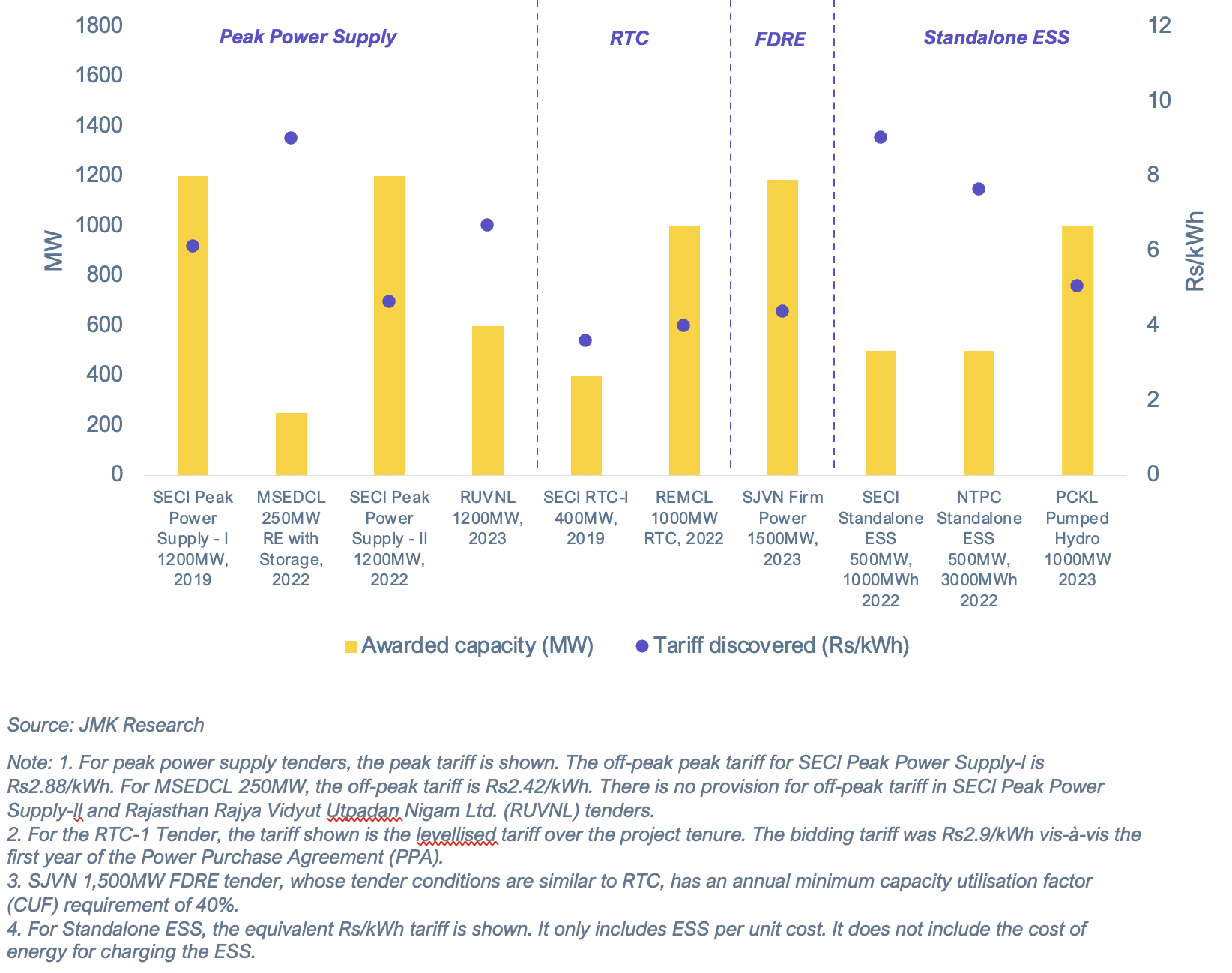

The tendering agencies, led by the Solar Energy Corporation of India (SECI), have developed several tender designs over the years to find the ideal model for India. It includes solar + BESS, peak power supply, round-the-clock (RTC), standalone ESS, and firm and dispatchable renewable energy (FDRE). These tenders, first issued in 2023, are demand profile-driven to ensure firmness and dispatchability of renewable energy and create a win-win scenario for power developers and offtakers.

Figure 1: Auction Results of Major Grid-scale ESS Tenders in India

Key Insights from Auction Results of Major ESS Tenders

- The discovered tariff in RTC tenders is lower than any peak power supply tenders, even though RTC tenders ensure higher availability and supply of renewable energy. This trend is due to the higher utilisation rate of ESS in the case of RTC tenders, leading to lower levellised tariff rates.

- The first FDRE tender to conclude was SJVN for 1,500 megawatts (MW) in November 2023. The tariff discovered was Rs4.38(US¢5.3)/kilowatt-hour (kWh), marginally higher than the RTC tenders.

- For other FDRE tenders, with stricter power-supply requirements in terms of demand fulfilment ratio, at a minimum of 90% of the demand profile monthly, the tariffs are expected to be higher, about Rs5(US¢6)/kWh.

- While the standalone storage tariff is lower than the other ESS tenders, these projects offer remarkable flexibility and provide value to the system in terms of the different applications offered, thus remaining competitive with other sources of flexibility.

- An important factor influencing the tariff of standalone ESS is the project tenure. For the tenders from SECI, NTPC and Power Company of Karnataka Limited (PCKL), the tenures are 12, 25 and 40 years, respectively. Falling ESS costs (especially for BESS) and sustained cash flow over a longer duration enable ESS developers to quote lower tariffs.

Despite the surge in ESS uptake in recent years, challenges remain. These include high initial capital expenditure (CAPEX), a longer gestation period of ESS projects (especially for PHS projects), suboptimal transmission and distribution (T&D) infrastructure, and a dearth of domestic manufacturing in ESS, highlighting potential supply chain risks.

With the increasing penetration of renewable energy, ESS will be the central disrupting technology in the 2020s power market. This decade, the ESS market will attract the highest investment of all emerging renewable energy sectors, concurrent with the increasing penetration of renewable energy in the electricity grid. With FDRE, India has found an ideal tender design that can be modelled according to the offtaker demand profile. Market stakeholders foresee that FDRE can match the power quality of thermal, potentially replacing it in the longer term. FDRE tenders will ultimately be crucial to reducing dependence on coal and other conventional power sources. Another key driver for the upsurge in ESS capacity will be the cost decline.

ESS trading on power markets is also likely to increase in coming years, driven by entities aiming to meet their energy storage obligation (ESO) targets and storage developers looking for avenues to sell the excess power from soon-to-be-commissioned grid-scale ESS projects. In addition to ESO, the government has issued other policy initiatives to support the growth of ESS. These include the viability gap funding (VGF) scheme for BESS projects, the national energy storage policy and the national pumped hydro policy. The national transmission plan to 2030,(1) issued by the Ministry of Power in December 2022, identifies ESS as a key component of upcoming power system development.

In terms of ESS technology, in the near term, large grid-scale ESS will favour PHS, mainly due to its levellised cost of energy (LCOE). However, with the likely decline in battery prices, BESS may overtake PHS as the most financially viable option to implement grid-scale ESS. In the long term, with green hydrogen-based ESS possibly attaining parity with PHS and BESS, green hydrogen may also become the dominant grid-scale ESS technology.

Footnotes:

(1) Ministry of Power. Transmission system for integration of over 500 GW RE capacity by 2030. December 2022.