There was no post-Christmas day hangover for Nio (NIO). Shares saw out Tuesday’s session 11% into the green with investors evidently impressed with the Chinese EV maker’s latest product unveil.

On December 23, the company held its annual NIO Day event, during which it introduced a new vehicle – the ET9 sedan, its “executive flagship” offering and representing its entry into the ultra-luxury automobile segment. With a focus on competing against the Porsche Panamera and the upscale S trim from Mercedes-Benz, the four-seater ET9 is set to hit the market in early 2025. Priced around $112,000, it surpasses the cost of the Tesla Model S . Notably, the ET9 features a design where each of the four seats is treated as an individual space, akin to the layout of first-class airplane suites.

Deutsche Bank analyst Edison Yu likes the look of the new car. “Encouragingly,” said Yu, “the new ET9 appears to be a proper flagship model featuring the latest cutting-edge tech (new AD chip replacing Orin, 3 lidars, 900V, 5C charging) and premium features (steer-by-wire, SkyRide suspension).”

That said, given Nio won’t begin delivering the new vehicle until 1Q25, there’s the risk of fading consumer interest with many new EVs launching between now and then.

Additionally, Nio also emphasized the proprietary technology integrated into the ET9 sedan with the vehicle also featuring a chip developed in-house. But given the recent large capital raise, Yu wonders if focusing on the development of so many technologies is a wise move. As per local media HiEV’s report, the tape-out cost for Nio’s 5nm chip is estimated to be $500 million.

At the end of the day, the event did little to alter the analyst’s overall stance. “Ultimately,” Yu summed up, “NIO Day didn’t change our thesis or near-term expectations. In a best-case scenario, ET9 can generate incremental excitement around the brand and act as a halo vehicle. Tactically, the key for the stock will be boosting sales volume after the big sales force revamp.”

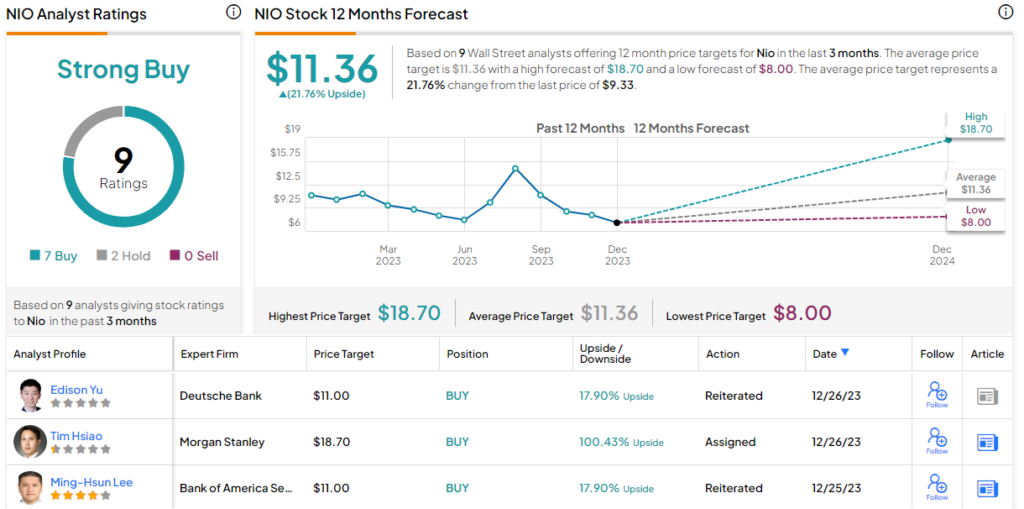

All told, Yu reiterated a Buy rating on the stock to go alongside an $11 price target, implying shares will climb 18% higher in the year ahead. (To watch Yu’s track record, click here)

Over the past 3 months, 9 analysts have waded in with NIO reviews, and these break down into 7 Buys and 2 Holds, all for a Strong Buy consensus rating. Going by the $11.36 average target, a year from now, shares will be delivering returns of 22%. (See Nio stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buya tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.