“I feel helpless and alone,” says the 38-year-old homemaker from Badlapur who, along with her teenage daughter, is surviving on charity.

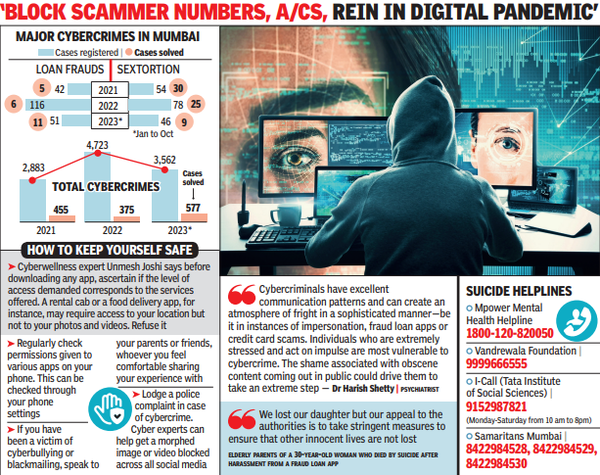

Cybercrimes such as sextortion and fraud loan apps- where harassment and blackmail are a common thread-are driving some of the victims to suicide and leaving their families wrecked. While 3,562 cybercrimes were registered by the Mumbai police between January and October, the actual number is higher. Experts have likened mounting cybercrimes to a “digital pandemic” and have called for strong measures, including accountability from intermediaries such as social media platforms.

Tulsibai last spoke to her husband, 41-year-old Mansingh, just a day before his death. Mansingh worked as a cook at a gurdwara in Santacruz and lived on the same premises. He had called her up, sounding agitated, and instructed her to mortgage her gold immediately. He also directed her to transfer the money to his bank account. On August 9, Mansingh hanged himself in his room.

Tulsibai wishes she had dug deeper when her husband asked her to arrange for money. Unknown to her, Mansingh was being blackmailed for money by some individuals posing as Delhi cyber police officers. They had shot an obscene video of his and threatened to upload it on YouTube if they were not paid. Mansingh had already transferred Rs 56,000 to them, but they wanted more. An FIR was only registered in October and the Santacruz police have still not formally communicated to her about the three arrests they have made in the case.

“My husband’s death has changed everything. My daughter will have to drop out of school and train to be a beautician so she can start earning soon. She wanted to study further, but we cannot afford it anymore. My son helps at a gurdwara and we survive on the little money they give us,” she said. After being sacked from her job, she hasn’t been able to find another. “I don’t have enough to pay home loan instalments and the bank is threatening to seize our house,” she said.

Like Tulsibai, Dattaguru Koregaonkar often finds himself fighting back tears. His 38-year-old brother, Sandeep, hanged himself in May 2022 after a fraud loan app called ‘Hello Cash’ morphed his photos with obscene content and circulated them among his friends to blackmail him into paying up. The case had pushed the authorities to go after loan app scamsters in a big way and unearth international links behind the operations. But Dattaguru says he has not kept track of the investigations.

Seated at his home in Malad’s Appapada, an uphill settlement of chawls, Dattaguru says he spends his time between running around hospitals for his father’s recurring medical procedures and trying to put food on the table for his large family. “Sandeep was a pillar of support and things have been tough without him by my side,” Dattaguru said. A week before he took his life, Sandeep had submitted a written complaint to the Kurar police about constant threats and obscene content sent by Hello Cash. “Had the authorities acted on time, Sandeep could have been alive. I’m disillusioned with the system,” Dattaguru said.

Cyber investigator Ritesh Bhatia says a big trend in cybercrime is fraudsters impersonating public servants for blackmailing people into paying up. “Creating deepfakes and impersonation are going to reach alarming proportions if immediate action is not taken. Blocking fraudsters’ phone numbers or social media handles and getting their bank accounts frozen is the first step. Intermediaries such as banks or social media platforms must take up more responsibility and create support cells to offer assistance to law enforcement agencies,” he said.

In some instances, calls have continued from fraud loan apps even after the victim’s death by suicide. A senior citizen couple from Dombivli were mourning their daughter’s demise when an individual associated with a loan app turned up at their doorstep to verify if she was indeed dead. Before the visit, he had called up her father and brother and sent them obscene content as she was not responding to their calls.

The 30-year-old woman had suffered the torment for eight months. “Our daughter had borrowed a small sum from the app to purchase stocks. But the lender kept asking for more and more repayment. We somehow helped her with funds initially. While the harassment continued, she chose not to confide in us for fear that it would rattle us,” said the elderly couple. After her morphed photos made their way to her friends and relatives, she jumped before a running train at Diva station in July.

Her parents couldn’t sleep properly for weeks when a relative who had accessed CCTV footage of Diva station told them how their daughter had been pacing up and down the railway platform and had scribbled “forgive me mother and father” on her wrist with a pen before she took the plunge.