Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

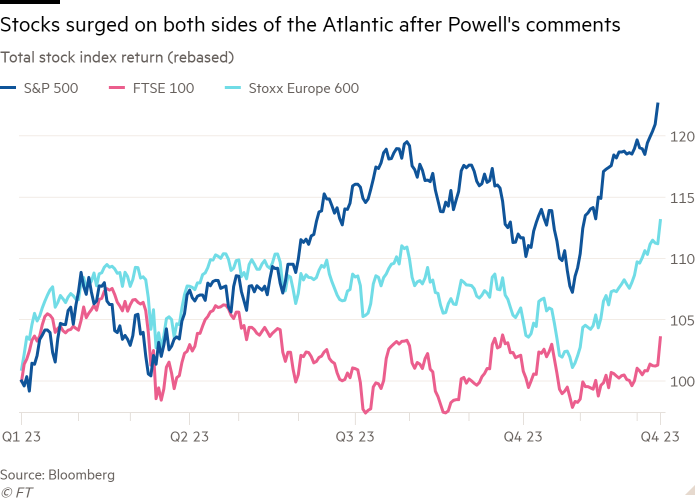

Stocks and government bonds advanced on Thursday as central banks in Europe diverged from the US, pushing back against market predictions of aggressive rate cuts early next year.

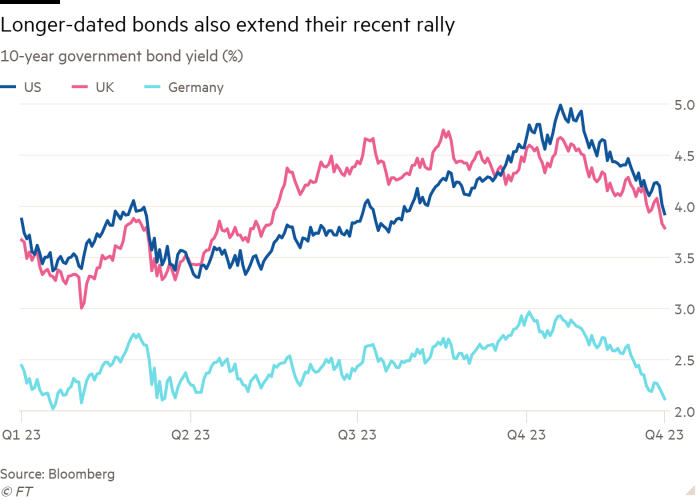

In New York the S&P 500 rose 0.4 per cent and the Nasdaq was up 0.4 per cent, leading a global equity market rally. Treasury yields fell sharply as new forecasts from Federal Reserve officials pointed to 0.75 percentage points of cuts next year, far more than investors had expected. Bond yields move inversely to prices.

“It’s a bumper early Christmas present” from the Fed, said Charles Hepworth, investment director at GAM Investments.

But European shares pared gains after the Bank of England and European Central Bank rejected growing market expectations that they were ready to cut rates.

BoE governor Andrew Bailey said there was “still some way to go” before inflation hit its target, while his ECB counterpart Christine Lagarde said there was “work to be done” to tame inflation and “we should absolutely not lower our guard” against consumer price pressures.

However, traders were betting on European rates following the US lower in 2024. Swaps markets were still pricing in around six 0.25 percentage point rate cuts for both the Fed and the ECB next year, and at least four from the BoE.

The Europe Stoxx 600 index was 0.5 per cent higher while the FTSE 100 traded 1 per cent higher in London. In bond markets, the yield on rate-sensitive two-year Treasuries fell 0.1 percentage points to 4.38 per cent while two-year German Bund yields, the eurozone benchmark, fell 0.09 percentage points to 2.56 per cent.

Ten-year Bund yields fell 0.03 percentage points to 2.14 per cent, the lowest level since March, while 10-year gilt yields were 0.06 percentage points lower at 3.77 per cent.

“Notwithstanding the BoE and ECB trying to push back on early rate cut expectations, Powell’s comments consequently dominated over Lagarde and Bailey,” said Mark Dowding, chief investment officer for RBC BlueBay fixed income.

The dollar weakened 0.9 per cent against a basket of peers while gold added 0.5 per cent to $2,037 per troy ounce.

Investors drew confidence from the Fed’s forecasts and comments from Fed chair Jay Powell that the central bank was “likely at or near its peak for this tightening cycle”.

Seema Shah, chief global strategist at Principal Asset Management, said the Fed had delivered “a significant about-turn . . . from emphasising higher for longer to, now, higher for shorter”.

Market expectations for interest rate cuts have greatly shifted in recent weeks after softer than expected inflation and economic data increased convictions that central banks have now tightened monetary policy enough to bring inflation back to their 2 per cent targets. Markets had been expecting the Fed to push back against the number of cuts priced in for next year.

Instead, “the exact opposite happened”, said Richard McGuire, head of rates strategy at Rabobank. “Unsurprisingly”, stocks were “loving life”, he said. “The Fed’s blindsiding of the market yesterday must surely be a watershed moment” for bond investors, he added.

Sterling rose 0.8 per cent to $1.2720 after the BoE said inflation “had some way to go” until it hit its target, while risks to its inflation forecast remained “skewed to the upside”.

“While the Fed is starting to discuss the potential for rate cuts, the choice for the BoE is still solely between holding or hiking,” said Matthew Landon, global market strategist at JPMorgan Private Bank.

“Markets were starting to smell a global pivot by central banks after the Fed shifted decidedly dovish last night. The BoE didn’t quite follow suit.”