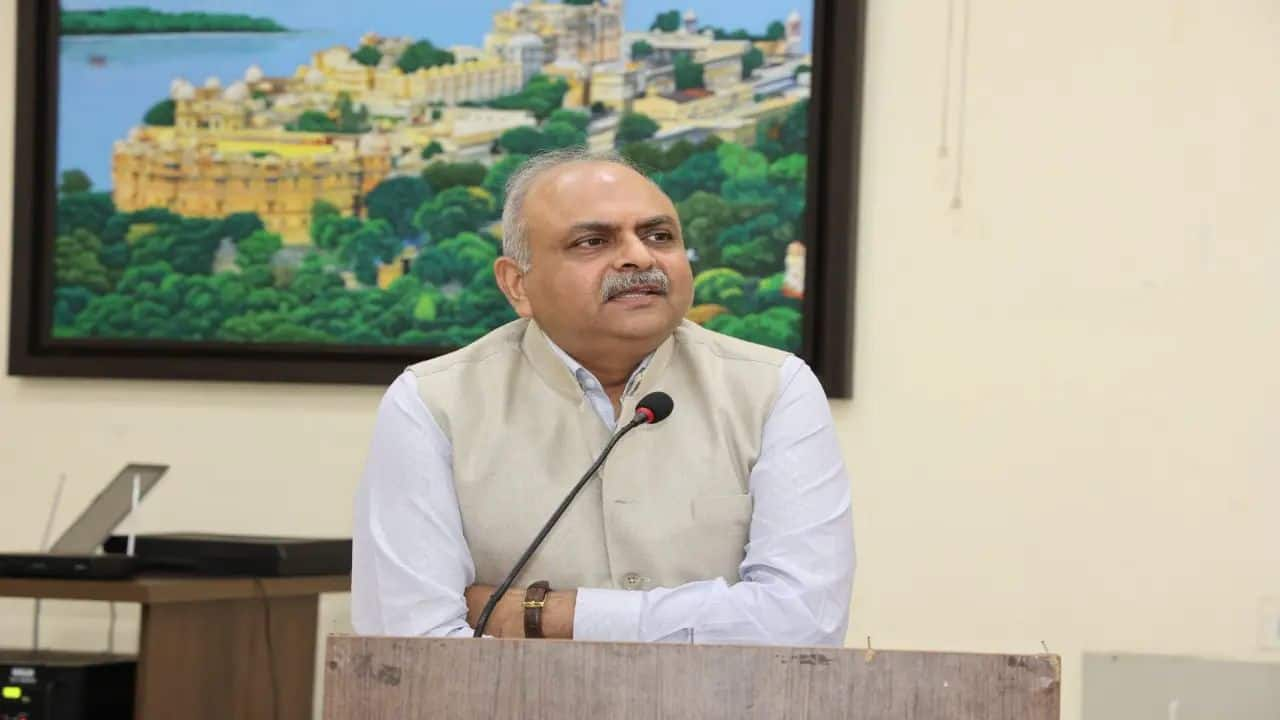

The government is preparing to make the Income Tax Act simpler than before. For this, a new version can be introduced in the next 6 months. Central Board of Direct Taxes (CBDT) Chairman Ravi Aggarwal gave this information in an exclusive conversation with Moneycontrol on Thursday, July 25. He said, “In the next six months, the Income Tax Act will be further simplified and this will be its new version.” After this, all the processes related to income tax including filing ITR will become easier than before.

Ravi Aggarwal said that out of the total Income Tax Returns (ITR) filed so far in the current financial year, more than 66 percent of the taxpayers have chosen the new tax regime. A total of four crore returns have been filed so far. He said the government’s focus is on ‘simplification’ of all processes including filing of ITR. “The government believes that the more you simplify, the easier it will be for people to follow the rules, which will lead to growth,” Aggarwal said.

CBDT Chairman said that there is enough attraction among the people regarding the new tax regime. About 66% of ITRs filed till date are under the new regime. It is expected that in future we will get more benefits under the new tax regime.

Aggarwal said he expects litigation to also reduce as rules are simplified. He also said that after the search, the assessment will be completed within the next 12 months. He admitted that a large number of cases are stuck in appeals and litigation.

On the question of removal of indexation benefit from sale of property, Ravi Aggarwal said that indexation on LTCG in the real estate sector used to cover inflation only marginally. He said, “The analysis shows that LTCG of 12.5 per cent may be more beneficial for investors. Property prices have increased by 5 times in the last 10 years.”

Central Board of Excise and Customs (CBIC) Chairman, Sanjay Aggarwal was also present in this conversation with Ravi. Sanjay said that steps have been taken in the budget to promote manufacturing. Basic customs duty on exporting industries related to marine production has been reduced.

Also read- Supreme Court allows states to collect royalty on minerals, decision shocks mining companies and Center