NACDAC Infra IPO Listing: Shares of infra company NACDAC Infra had a successful entry on BSE SME today and the money of IPO investors doubled on the very first day. Its IPO also got a good response and overall bids were more than 2,209 times. Shares have been issued under the IPO at a price of Rs 35. Today it has entered BSE SME at Rs 795.00, which means IPO investors got a listing gain of 11 percent (NACDAC Infra Listing Gain). After listing the shares went up further. It jumped and reached the upper circuit of Rs 69.82 (NACDAC Infra Share Price), which means the money of IPO investors has doubled.

NACDAC Infra IPO got strong response

NACDAC Infra’s ₹10.01 crore IPO was open for subscription from December 17-19. This IPO received an overwhelming response from investors and overall it was subscribed 2,209.76 times. In this, the portion reserved for Qualified Institutional Buyers (QIB) was filled 236.39 times, the portion for Non-Institutional Investors (NII) was 4,084.46 times and the portion for retail investors was filled 2,503.66 times. Under this IPO, 28.60 lakh new shares with face value of Rs 10 have been issued. The company will use the money raised through these shares to meet working capital requirements and for general corporate purposes.

About NACDAC Infra

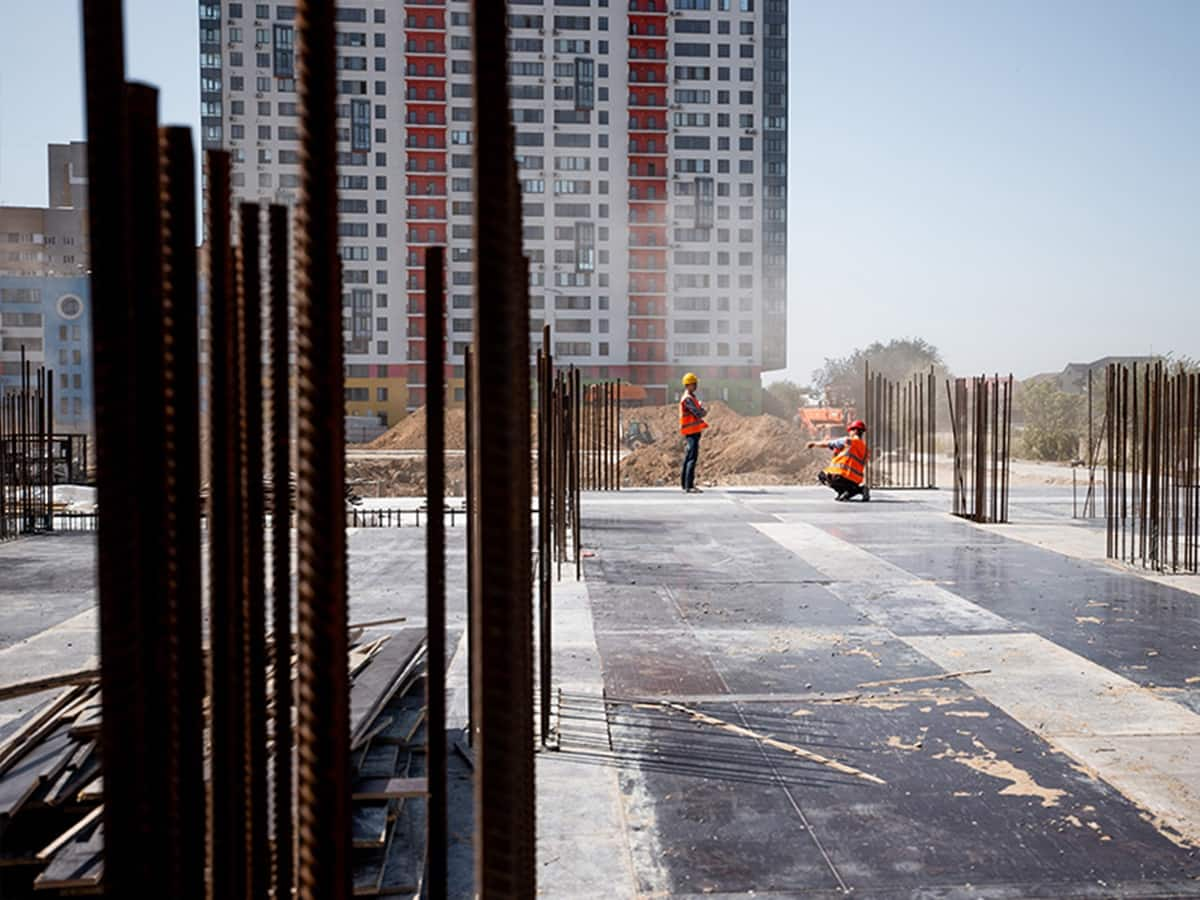

NACDAC Infra, formed in the year 2012, manufactures multi-storey buildings, residential, commercial and institutional structures. It has so far completed 45 projects of the Government of India and the Government of Uttarakhand. Talking about the financial health of the company, it has continuously strengthened. It had a net profit of Rs 31.55 lakh in the financial year 2022, which jumped to Rs 56.15 lakh in the next financial year 2023 and reached Rs 3.17 crore in the financial year 2024. During this period, the company’s revenue increased at a compound growth rate (CAGR) of more than 87 percent annually to Rs 36.33 crore. Talking about the current financial year 2024-25, it has achieved net profit of Rs 1.60 crore and revenue of Rs 13.76 crore in April-October 2024.