Budget 2023- Old Tax Regime vs New Tax Regime: Union Finance Minister Nirmala Sitharaman (Nirmala Sitharaman) has given a big gift to the salaried class today. For the first time since 2014, the tax exemption limit has been increased and the tax rebate limit has also increased. Under the new tax system, the number of tax slabs has been reduced from 6 to 5. However, the tax relief announced by the Finance Minister today is under the new tax system. In such a situation, the question arises that when the Finance Minister has not given any relief regarding the old tax system, then why should the taxpayers choose it.

Budget Live Updates

Which to choose between the new and old tax system?

Union Finance Minister Nirmala Sitharaman has not made any changes in the old tax system today. The rate has also been reduced in the new tax system. In such a situation, now the new tax looks more attractive than the old one. It can be understood that under the old tax system, the tax rate on income of Rs 5 lakh-10 lakh is 20 percent, whereas under the new tax system, the tax rate on income of Rs 6-9 lakh is only half i.e. 10 percent. However, keep in mind that if you want to avail the benefit of deduction by investing, then it will not be available in the new tax system, that is, if you want to save tax on investment in investment schemes like PPF, then you will have to choose the old tax system only. However, if the income is high i.e. more than Rs 10-15 lakh then the new tax system is better.

Budget 2023-Agniveers: Special announcement in the budget for Agniveers, Finance Minister gave big relief in tax.

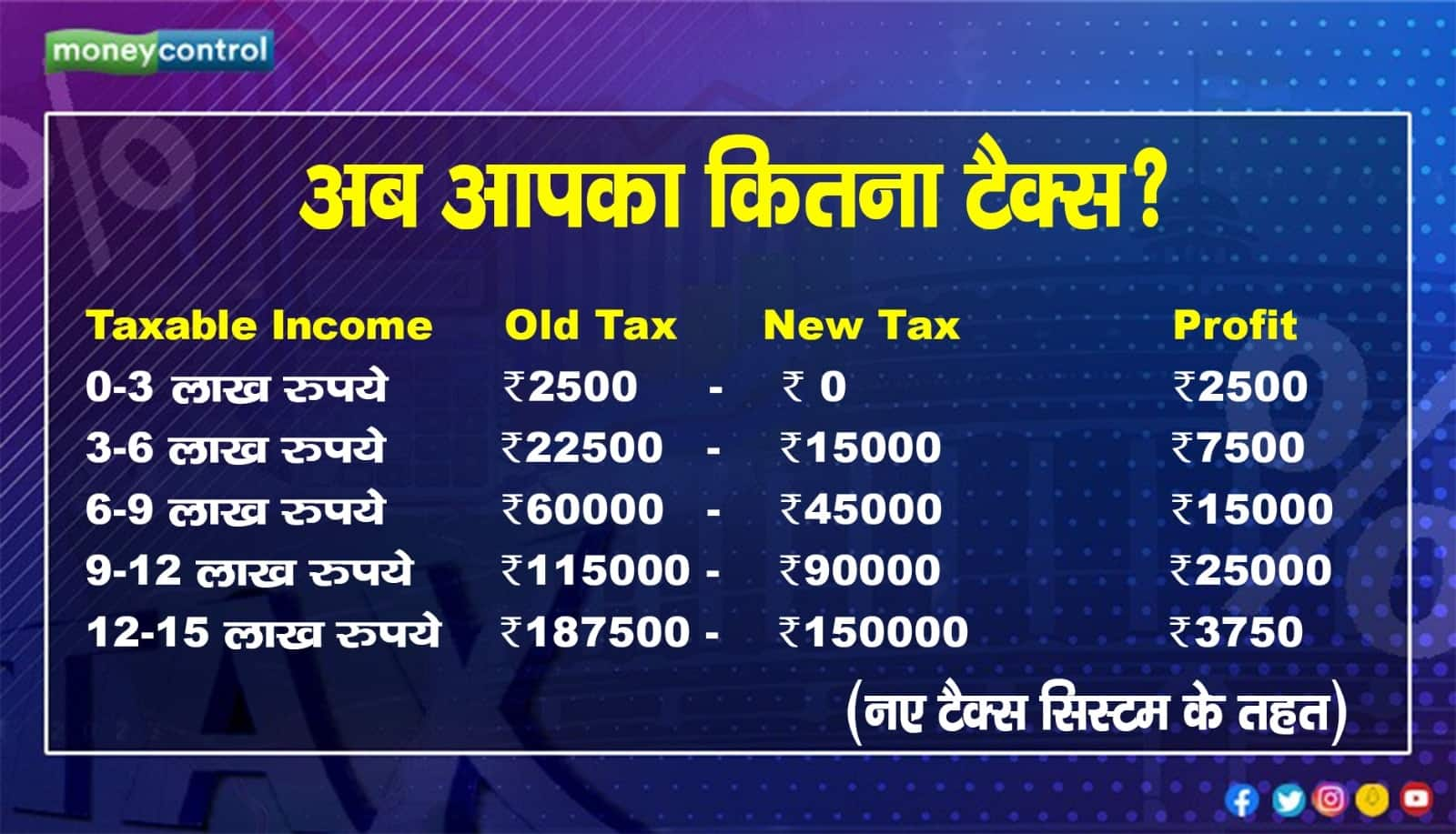

How much benefit will there be from rate cuts in the new tax system?

Now the next question that arises is that when Finance Minister Nirmala Sitharaman has reduced the tax rates under the new tax system, how much benefit will be received from it. Earlier income up to Rs 5 lakh was tax free, which has now been increased to Rs 7 lakh. Now, if we talk about taxpayers with income of more than Rs 7 lakh, then how much money will be saved for the taxpayers, it can be understood like this-

What does it mean to make the new tax system default?

The Finance Minister has today announced the removal of the old tax system from default. Now the new tax system has been made default. This means that now if taxpayers choose the old tax system, they will have to fill a form to indicate this.

Know all the tax related announcements point wise

Under the new tax system, income up to Rs 7 lakh will be tax-free.

Under the new tax system, tax slabs were reduced and exemption limit was reduced to Rs 3 lakh.

Salaried class and pensioners will now get the benefit of standard deduction in the new tax system and it has been fixed at Rs 52500.

Under the new tax system, the highest surcharge has been reduced from 37 percent to 25 percent, that is, now the highest tax rate will be 39 percent instead of 42.74 percent.

The new tax system was made by default.