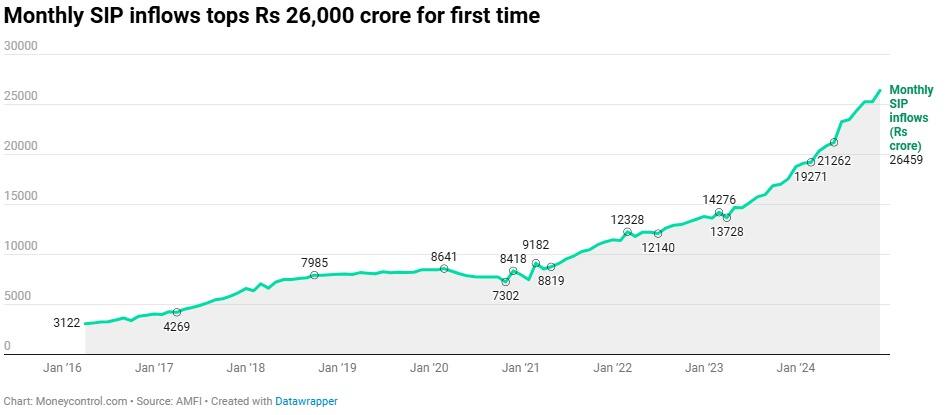

Despite selling pressure in the domestic stock market, investment in equity funds is increasing rapidly. According to data from mutual fund body AMFI (Association of Mutual Funds of India) last month, inflows into open-ended equity mutual funds increased by 14.5 per cent year-on-year to Rs 41,155.91 crore in December 2024. It remained in the positive zone for the 46th consecutive month. Most of the investments came in thematic/sectoral and small cap funds. At the same time, monthly investment through Systematic Investment Plan (SIP) has crossed Rs 26 thousand crore for the first time. Investments worth Rs 26,459 crore came through SIP in December, whereas in November this figure was Rs 25,320 crore. Sensex and Nifty 50 weakened by more than 2 percent last month.

Investors’ confidence in small cap funds increased

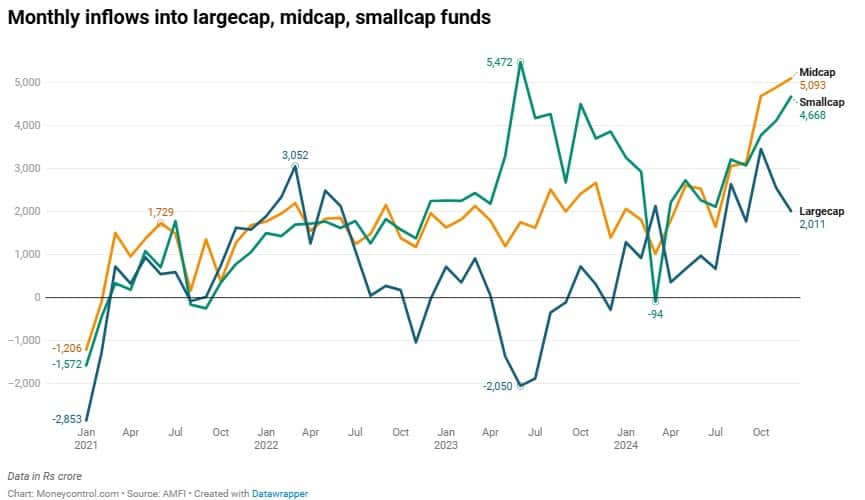

Manish Mehta, National Head (Sales, Marketing and Digital Business), Kotak Mahindra AMC (Asset Management Company), says that due to the increasing products, investors are investing according to their risk and are looking at mutual funds as an effective way of investing. Investor confidence remains strong. In the equity segment, investor inflows in sectoral/thematic funds category doubled on a monthly basis to Rs 15,331.54 crore in the month of December. The investment got good support from the New Fund Offer (NFO). Last month in December, 12 NFOs including Aditya Birla Sun Life Conglomerate Fund, Axis Momentum Fund, Bajaj Finserv Healthcare Fund, Bank of India Consumption Fund, ICICI Prudential Equity Minimum Variance Fund and SBI Quant Fund raised Rs 11,337 crore. Net inflows in the small cap fund category increased by 13.5 per cent to Rs 4,667.70 crore. There was a decline in inflows into multi cap, large cap and large and mid cap funds.

October’s record could not be broken

Last month, in the month of December, there were more inflows than withdrawals in open-ended equity funds for the 46th consecutive month. However, the October record could not be broken. Inflows into open-ended equity mutual funds stood at Rs 41,155.91 crore in December 2024 and hit a record high of Rs 41,887 crore in October. Investments in open-ended equity mutual funds had fallen to Rs 35,943.49 crore in November.

Now talking about overall open-ended funds, there was a net outflow of Rs 80,509.20 crore in the month of December as compared to Rs 60,363.70 crore in the month of November. There was a net withdrawal of Rs 1,27,152.63 crore from debt in the fixed income segment. There was a net outflow of Rs 66,532.12 crore from the liquid fund category and Rs 25,842.96 crore from the money market fund segment and Rs 22,347.58 crore from overnight funds. However, buying was slightly more than selling in the long duration fund and gilt fund categories. Net Assets Under Management (AUM) of the mutual fund industry fell from Rs 68.08 lakh crore to Rs 66.93 lakh crore during this period.