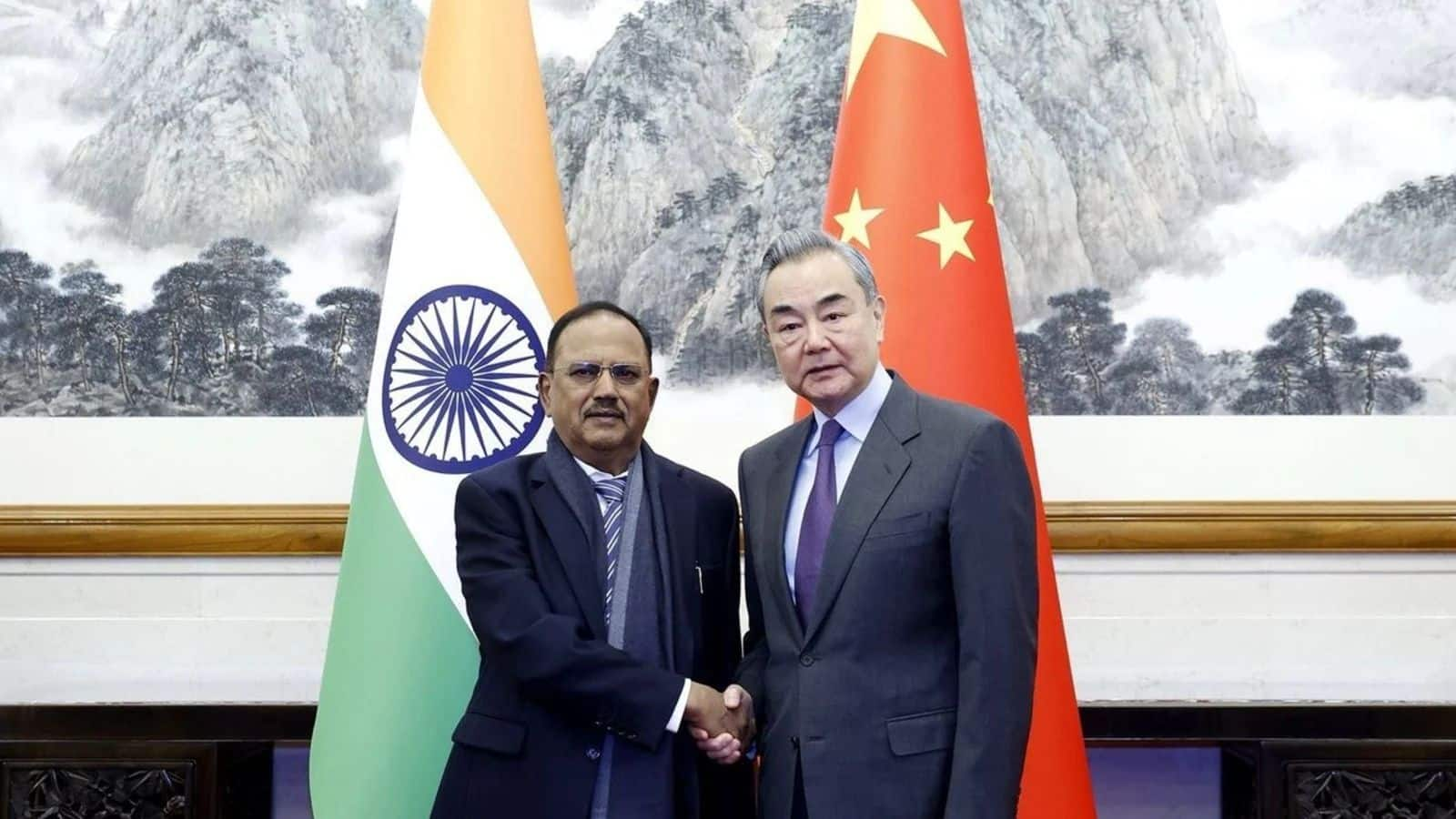

China’s Foreign Minister and Politburo member Wang Yi 18–19 Coming to New Delhi on August. They will participate in the 24th meeting of special representatives on the Indo-China border dispute. This tour is India–China is happening at a very sensitive time for relations. Let us know that later this month, Prime Minister Narendra Modi’s Shanghai Cooperation Organization in Tianjin (China) (SCO) It is expected to visit the summit.

Chinese Foreign Minister Wang Yi will discuss new confidence restoration for permanent peace and stability on the disputed border between the two countries during this period.

PM will meet Modi

Ministry of External Affairs (Something) According to the program of, China’s Foreign Minister Wang Yi is coming to India on a three -day tour tomorrow. During his visit, he will meet Prime Minister Narendra Modi at his official residence, 7 Lok Kalyan Marg at 5:30 pm on 19 August (Tuesday). As per the scheduled schedule, Wang Yi on Monday evening at 4:15 pm Delhi IGI Will reach the airport. After this he was Foreign Minister S.K. Will meet Jaishankar. 24th meeting of special representatives on India-China border issue on Tuesday In Will take part.

This tour is very important

The two countries are eyeing Wang Yi’s visit to India. It is considered a positive step towards improving relationships and further widespread cooperation. Last year, Prime Minister Narendra Modi met Chinese President Xi Jinping in Kazan. That Conversation After India and China agreed to partially reduce the deadlock in Ladakh. Earlier this year, the two countries indicated to improve the relationship. China resumed the Kailash-Mansarovar Yatra, while India resumed visa to Chinese tourists.

PM Modi will go to China in late August

India and China are preparing to resume direct flights soon. Hopefully it will be announced in early September, When Prime Minister Narendra Modi will attend the Shanghai Cooperation Organization (SCO) summit to be held in Tianjin, China in late August. Last month, India resumed the release of tourist visas for Chinese citizens. Before the Visa suspension, airlines like Air India, IndiGo, Air China, China Southern and China Eastern used to run direct flights for big cities like Beijing, Shanghai, Guangzhou and Kunming from Delhi, Mumbai and Kolkata. At that time more than a dozen flights were operated every week.