GPF Rule Change 2022: The General Provident Fund is a saving fund for serving central government employees. All the government employees under the Department of Pension & Pensioners’ Welfare get the benefit of this scheme. Just like the Employees Provident Fund, a GPF account allows central government employees to contribute a certain percentage of their salary to the scheme. The deposits in the GPF earn a stable interest as decided by the central government. For the October to December 2022 quarter, the central government has set the GPF interest rate at 7.1 per cent.

Change in General Provident Fund Rule:

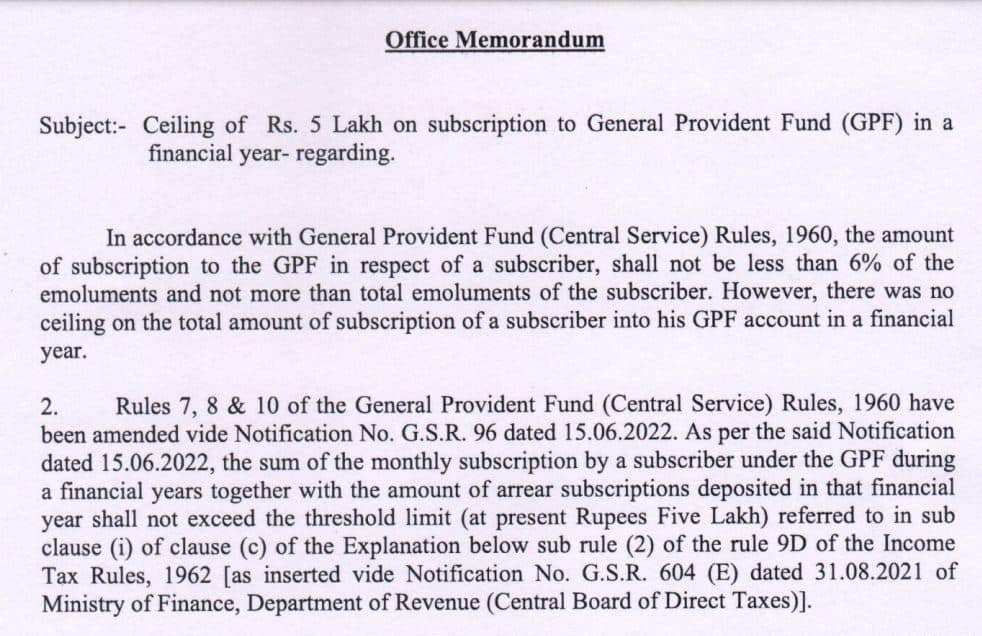

To weed out ambiguities and make the fund more transparent, the Department of Pension and Pensioners’ Welfare under the Ministry of Personnel, PG and Pensions has made a change in the deposit rule of the General Provident Fund.

“In accordance with General Provident Fund (Central Service) Rules, 1960, the amount of subscription to the GPF in respect of a subscriber, shall not be less than 6% of the emoluments and not more than total emoluments of the subscriber,” said the Department in a notification dated October 11. The department underlined that there was no ceiling on the total amount of subscriptions of a subscriber into his GPF account in a financial year.

Also Read: Diwali GIFT from Gujarat government: 2 free LPG cylinders, 10 per cent reduction in VAT on CNG, PNG

The department further said that the government has decided to fix a maximum annual limit of Rs 5 lakh on the GPF contributions.

“….the sum of the monthly subscription by a subscriber under the GPF during a financial year together with the amount of arrears subscriptions deposited in that financial year shall not exceed the threshold limit (at present Rs five lakh)…” said the notification.

It urged all the ministries/departments to notify all the related ministries and departments in order to create awareness about the maximum ceiling.

It may be noted that GPF is managed by the Department of Pension and Pensioners’ Welfare. An employee’s contribution to the general provident fund is stopped three months before the date of his/her superannuation and immediate payment of the final balance is done upon the retirement of the employee.