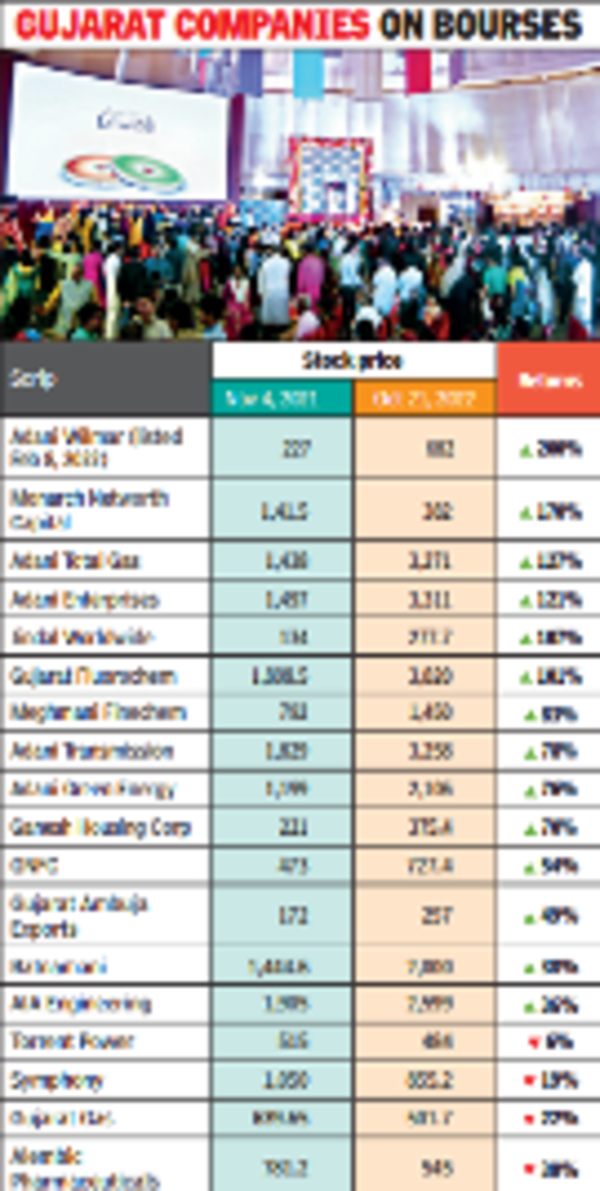

Gujarat-based Adani Group continues to outperform the broader markets. Adani Wilmar has given almost 200% returns since its debut on the exchange while Adani Total Gas and Adani Enterprises also gave returns of more than 100% in a year. In the small and mid cap group, the stock of Ahmedabad-based stock broking and financial services firm Monarch Networth Capital has rallied by 170%, denim manufacturer Jindal Worldwide has risen by 107% and the stock price of Gujarat Flourochem has increased by 101% since last Diwali.

Meghmani Finechem, Ganesh Housing Corporation and GNFC also gave returns of more than 50% in the last year. However, companies such as Symphony, Bodal Chemicals, Gujarat Gas, Alembic Pharma and Astral have given negative returns in the last year.

Vaibhav Shahdirector of a stock broking and financial services company said, “Many negative factors affected the markets such as rising inflation and interest rates, the Russia- Ukraine war, high crude oil prices, the dollar index going up by 20% and 10% depreciation of the Indian rupee against dollar and FIIs selling of $28 billion. However, the Indian markets have been relatively resilient, remaining more or less flat (-2%) since last Diwali.

The Nifty small cap 100 and Nifty mid cap 100 indexes have given -13% and -2% returns, respectively, in this period. Of Gujarat-based companies, 19 (73%) of the 26 major companies have given strong returns.”

Gunjan Choksi, founder of a city-based stock broking firm said, “Certain Gujarat-based companies rewarded investors with wonderful returns at a time when the world markets traded up to 40% down from their yearly highs during the last samvat. Most Gujarat-based corporates understand changes to their business after Covid and are ready to capitalize on changed times and leave their footprint on the global map. Some chemical companies are preparing large capex plans and we may see them tripling in size in next five years. Gujarat, with its mature politico-economic environment is going to gain prominent place on the global map in the next decade.”

Aasif Hiranidirector of a stock broking firm said, “India’s outperformance against developed markets is expected to continue in Samvat 2079 despite high valuations. The support of domestic institutional investors will continue to compensate for FII selling. This Q2, corporate earnings are in line with optimistic expectations. Macro-economics and earnings fundamentals will continue to justify higher valuation of our indices against peers with Nifty expected to trade in the range 16,600-18,300 range for Samvat 2079.”