The MPC is expected to meet towards the end of the month as a communication must be sent to the government within a month of the retail inflation data being released. Inflation based on the consumer price index (CPI) is due to be released on October 12.

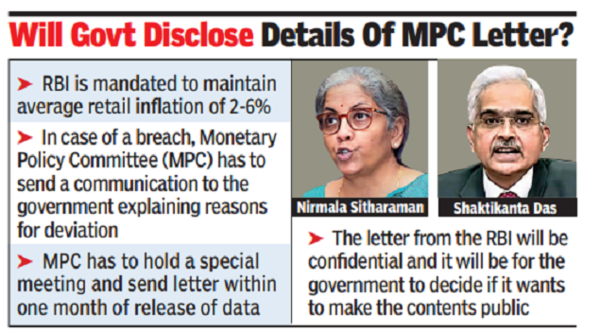

Officials said that under the law, the letter from the RBI will be confidential and it will be for the government to decide if it wants to make the contents public. “It is privileged communication and it cannot simply be released. It is not the only communication between the regulator or other wings of the government that is confidential,” said an officer.

They explained that based on the communication, the finance ministry will decide if other steps are required, although the government and the central bank have already taken several steps to cool down inflation.

While the MPC has raised rates by 1.9 percentage points, the government has tweaked import duty on several products, including farm goods, in addition to restricting export of several items in a bid to enhance availability in the domestic market.

A few years ago, the government had amended the RBI Act, which led to the establishment of the MPC and a target of 4% inflation was fixed, allowing for deviation of up to 2% on either side.

While inflation has remained largely within the band, for the last few months it has remained above 6%, first due to the impact of Covid-19 and supply disruption and subsequently due to the war in Ukraine, which sent global commodity prices soaring.

RBI expects inflation to moderate to 5.8% during the March quarter, compared to the 7% reading in August. RBI expects retail inflation to come closer to the 4% target over a two-year cycle. “That is our expectation even now. But there are so many uncertainties that are playing from time to time,” RBI governor Shaktikanta Das had said during the post-policy media interaction on Friday.