New Delhi: The requirements for allocating equity have been changed by the Pension Fund Regulatory and Development Authority (PFRDA) for Tier 1 and Tier II National Pension System (NPS) accounts. The new rule states that subscribers who turn 51 years old can allocate up to 75 per cent of their money to equities (E) under active choice in a Tier-I account without any tapering limitations.

The statutory regulating authority permits, without any limitations, at age 51, the opportunity to allocate 100 per cent of the subscriber’s contribution to Asset Class E (Equity) in Tier-II accounts under active choice. (Also Read: Want to record videos in cinematic style using your iPhone? Use THIS feature to get quality shots)

The NPS-All Citizen Model currently gives NPS subscribers the choice of selecting any one of the registered Pension Funds and actively allocating their contributions across four asset classes: equity (E), corporate bonds (C), government securities (G), and alternative assets (A).

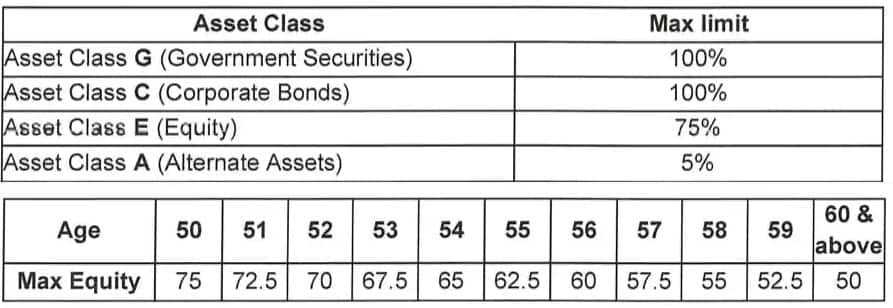

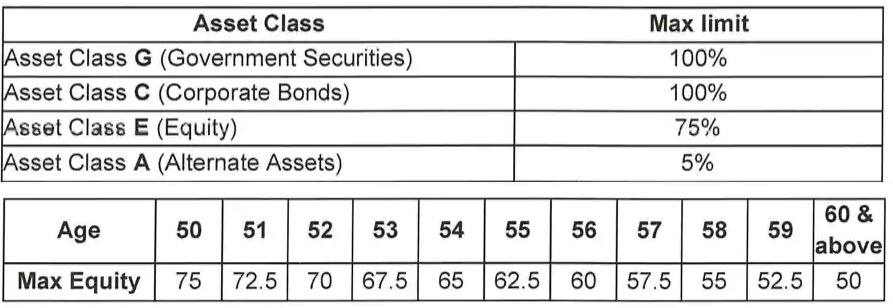

This option is known as “Active Choice.” The maximum allocations to various asset classes are as follows:

The 75 per cent maximum on asset class E, however, is reduced by 2.5 per cent annually and transferred to government securities once a subscriber becomes 51. The age-based maximum equity criteria are based on the following matrix:

In a circular dated October 20, 2022, PFRDA stated that “the Authority has decided to offer option to allocate 75% of subscriber’s contribution in Asset Class E (Equity) in Tier-I under active choice without any limitations of tapering from the age of 51 years.”

Additionally, the regulator decided to permit the option of allocating 100% of the subscriber contribution in Asset Class E (Equity) in Tier-II (Optional Account) under Active Choice without any tapering requirements.