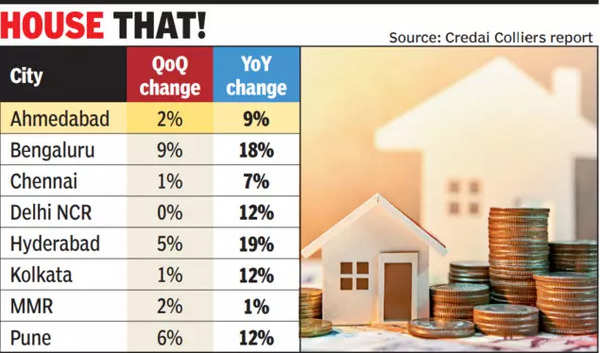

The report reveals that all eight cities examined exhibited a rise in housing prices, with Hyderabad leading at a remarkable 19% YoY, closely trailed by Bengaluru at 18%.The nationwide unsold inventory stood at approximately 10 lakh units by the end of the third quarter of 2023, with Ahmedabad contributing a 9% share.

The ‘India Housing Price Tracker,’ a collaborative report by Credai and Colliers, highlights, “Housing prices in Ahmedabad rose 9% YoY to Rs 6,613 per square feet (carpet), driven by increased demand and upcoming commercial developments in the Gandhinagar suburb.” The Gandhinagar suburb witnessed the highest price surge at 11% YoY, followed by the eastern suburb. Anticipating the second phase of the metro and ongoing infrastructure development around GIFT City, the report suggests that housing prices will likely grow further in the Northwest and Gandhinagar suburbs. Viral Shah, vice-president of Credai Ahmedabad, said, “The past year has been positive for the economy, and housing demand in top cities has remained strong. Ahmedabad remains the most affordable housing market compared to other megacities. While affordable housing prices have increased moderately, the premium segment has witnessed a significant price surge. The city provides enhanced infrastructure and employment opportunities, ensuring that housing demand will thrive in the coming years.”

The average housing prices pan-India recorded a 10% YoY increase at Rs 9,937 per sq ft during Q3 2023, driven by sustained housing demand and positive sentiment among home buyers. The report also notes that the luxury housing segment maintained robust sales momentum.

Although unsold units across the country experienced a marginal sequential drop after eight consecutive quarters of increase, there was a 6% annual rise due to the surge in launches of ultra-luxury properties, stated the report. Most unsold units were in the mid-segment with a 32% share, followed by the affordable segment. While all cities observed increased unsold inventory levels, Delhi NCR witnessed a 7% YoY drop.