The initial public offering of cryogenics equipment manufacturing company Inox India is open for subscription during December 14-18. Currently fully owned by the promoter group, post issue the promoter shareholding shall drop to around 76 per cent.

At the upper end of the price band, the total offer is around ₹1,459 crore and its market cap will be ₹5,990 crore. While the stock is priced at a trailing P/E of around 38 times, its closest global peer, Chart Industries (listed in US), trades at a P/E of around 22 times. Chart Industries has also seen high revenue growth in the last three years but has generated lower margins than Inox India.

Overall, though Inox India operates in a niche segment and the company is performing well now, its business is vulnerable to the broader capex cycle (cyclical). Considering this, the valuation looks expensive. Hence, investors can wait and watch for better opportunities to enter the stock.

Business

The company manufactures and supplies cryogenic equipment, offering solutions across design, engineering, manufacturing and installation of equipment and systems. Typically, cryogenic equipment is used to store, transport and handle cooled gases in liquid form. They find application in industrial sectors such as industrial gases, liquefied natural gas (LNG) , green hydrogen, energy, steel, medical and healthcare, chemicals and fertilisers, aviation and aerospace, pharmaceuticals, and construction. Hence, the demand for cryogenic equipment is driven by the capex deployed in these sectors.

The company mainly operates in three segments — industrial gas (70 per cent of revenue), LNG (25 per cent), and cryo scientific (five per cent).

Its industrial gas division designs, manufactures, supplies and installs vacuum-insulated cryogenic storage tanks and systems for the storage, distribution and transportation of industrial gases, wherein it providesturnkey as well as EPC solutions. Air Liquide Global E&C Solutions, Hyundai Engineering and Construction, Naveen Flourine, and All Safe Global are some of its customers in the segment.

Its LNG division manufactures, supplies and installs standard and engineered equipment for LNG storage, distribution and transportation as well as small-scale LNG infrastructure solutions suitable for industrial, marine and automotive application. Its customers here include Caribbean LNG Inc, IRM Energy Limited, Saint Gobain India Private Limited, and Shell Energy India Private Limited.

The cryo scientific segment supplies specialised engineered equipment for scientific applications focused on satellite and launch facilities, cryogenic propulsion systems and research, and fusion and superconductivity. Here the company’s primary customer is ISRO.

The company’s principal raw materials include aluminium products (sheets, bars, plate, and piping), stainless steel products (sheets, plates, heads, valves, instruments and piping), palladium oxide, carbon steel products (including sheets, plates, sections and heads), valves and gauges, and fabricated metal components. The company typically sources the raw material on spot basis, which exposes it to volatility in raw material prices. Further, nearly 45 per cent of the company’s sales are from exports.

Financials

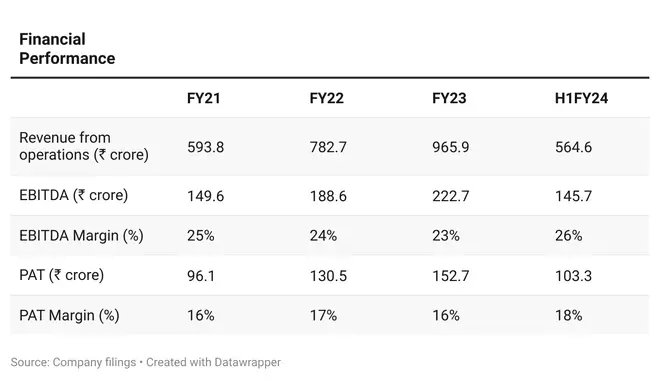

The company has seen a CAGR of around 27 per cent in its operating revenue during FY21-23 to around ₹966 crore. This was mainly supported by 35 per cent CAGR growth during the period in the industrial gases segment, driven by sustained investment to improve India’s medical oxygen infrastructure and revival of industrial demand for gases. Its EBITDA growth has been in line with the revenue growth, posting EBITDA of around ₹226 crore; hence the company has been able to maintain its EBITDA margin of 23-25 per cent and pass on the volatility in steel prices to its customers. Further, revenue and EBITDA grew by nearly 16 per cent and 20 per cent, respectively, to around ₹565 crore and ₹487 crore during H1FY24.

As the company operates on an asset-light model, it doesn’t have significant debt on its balance sheet, resulting in D/E of around 0.08 times as on September 30, 2023.

Outlook

The company has an order book of around ₹1,036 crore, which it expects to be executed in the next 6-12 months. Of the total order book, industrial gas comprises 53 per cent, followed by LNG and cryo scientific at around 25 per cent and 22 per cent, respectively. The company currently has three manufacturing facilities and is setting up a fourth facility too. It has incurred capex of around ₹80 crore during H1FY24 and the management has guided for similar capex during H2FY24.

As per CRISIL, demand for cryogenic equipment is expected to be driven by the increased demand for cleaner fuels such as LNG and hydrogen due to the global focus on reducing carbon emissions from conventional energy sources. Further, one needs to note that a majority of the industries the company serves are cyclical in nature and hence vulnerable to global economic downturn. In FY23 the company derived 45 per cent of its revenue from exports and whether this may be impacted by the global economic slowdown needs to be monitored.