Union Budget 2023: Finance Minister Nirmala Sitharaman has given big relief to the working people. He was expecting big tax relief in the Union Budget 2023. If a person with an annual income of Rs 7 lakh selects the new tax regime, then he will not have to pay any tax. Tax rates are lower in the new tax regime, but deduction under section 80C, HRA exemption, health insurance deduction and other tax benefits are not available. All these benefits are available in the old regime of income tax. If your income is up to Rs 7 lakh, then you will be entitled to a rebate of Rs 25,000 in the new tax regime.

How to get tax benefit?

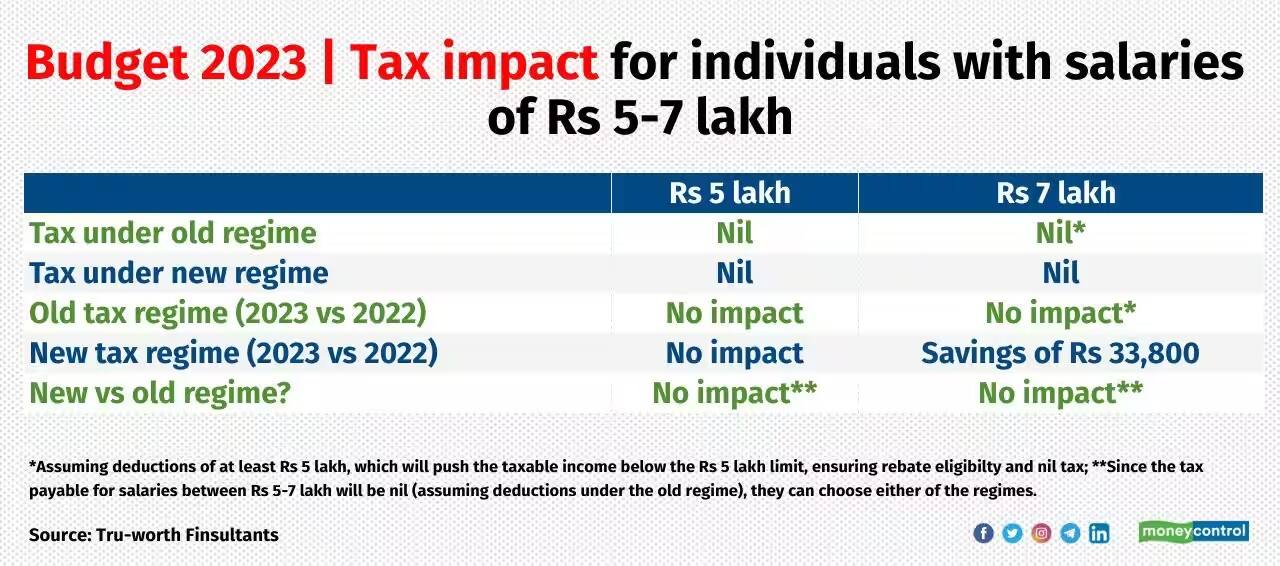

This means you will not have to pay any tax. But to claim rebate you will have to file income tax return. Earlier, a rebate of Rs 12,500 was available for people with income up to Rs 5 lakh in both the old and new tax regimes. Currently, in the old tax regime, people with an annual gross salary of Rs 5 to 7 lakh have to pay tax at the rate of 20 percent. However, if they claim standard deduction of Rs 50,000 and deduction of Rs 1.5 lakh under Section 80C, their gross salary falls below the rebate limit. This means that they also do not need to pay any kind of tax.

Also read: Budget 2023: Nirmala Sitharaman has solved the old problem of senior citizens, know here how

According to the tax calculations of TrueWorth Finconsultants, if you had selected the new tax regime last year and want to remain in it in the next financial year i.e. 2023-24, then you will be able to save an additional Rs 33,800 in tax.

There will be no benefit in switching from old to new regime.

If you had selected the old tax regime last year and claimed tax benefits of at least Rs 2 lakh and want to continue in the old regime in the next financial year, then switching to the new tax regime will save you additional tax. There will be no benefit. However, in the new tax regime, there will be no need to make tax saving investments and other types of compliances.