The benchmark indices fell sharply by more than 2 per cent in the week ending January 10. The broader index fell more than the benchmark indices due to a reduction in GDP growth estimates for the full year, rising oil prices and continued selling by foreign institutional investors. The rise in US bond yields and strength in the US dollar index also influenced sentiment. Apart from this, there is some uncertainty in the market regarding the policy actions that can be taken by Donald Trump, who will take charge as US President on January 20.

Nifty50 fell 573 points to 23,432, its lowest level since June 2024. BSE Sensex fell 1,844 points to 77,379. The Nifty Midcap 100 and Smallcap 100 indices were down 5.77 per cent and 7.3 per cent, respectively. All sectors except IT were under pressure. Consolidation is expected in the market in the next week starting from January 13. Let us know which factors will play an important role in deciding the direction of the market in the new starting week…

Q3 earnings of companies

Market participants will mainly keep an eye on the third quarter results of companies. In the new week, Reliance Industries, Infosys, HCL Technologies, Tech Mahindra, Wipro, Kotak Mahindra Bank, HDFC Life Insurance Company, Axis Bank, SBI Life Insurance will release their Q3FY25 results. Apart from this, HDFC AMC, LTIMindTree, L&T Technology Services, Jio Financial Services, RBL Bank, Indian Hotels, Anand Rathi Wealth, Angel One, Delta Corp, Network18 Media and Investments, Shoppers Stop, CEAT, Bank of Maharashtra, Havells India, Mastek, Metro Brands, Sterling & Wilson Renewable Energy, Ather Industries, Concord Enviro Systems and ICICI Lombard General Insurance Company will also release Q3 earnings.

December inflation figures

Retail inflation figures for the month of December will be released on January 13. These will play an important role in shaping the direction of the market. Most economists expect inflation figures to decline further in the last month of 2024. Apart from this, wholesale inflation figures for December will be released on January 14. It may increase. Bank credit and deposit growth data for the 15-day period ending January 3 and foreign exchange reserves data for the week ending January 10 will be released on January 17.

American inflation

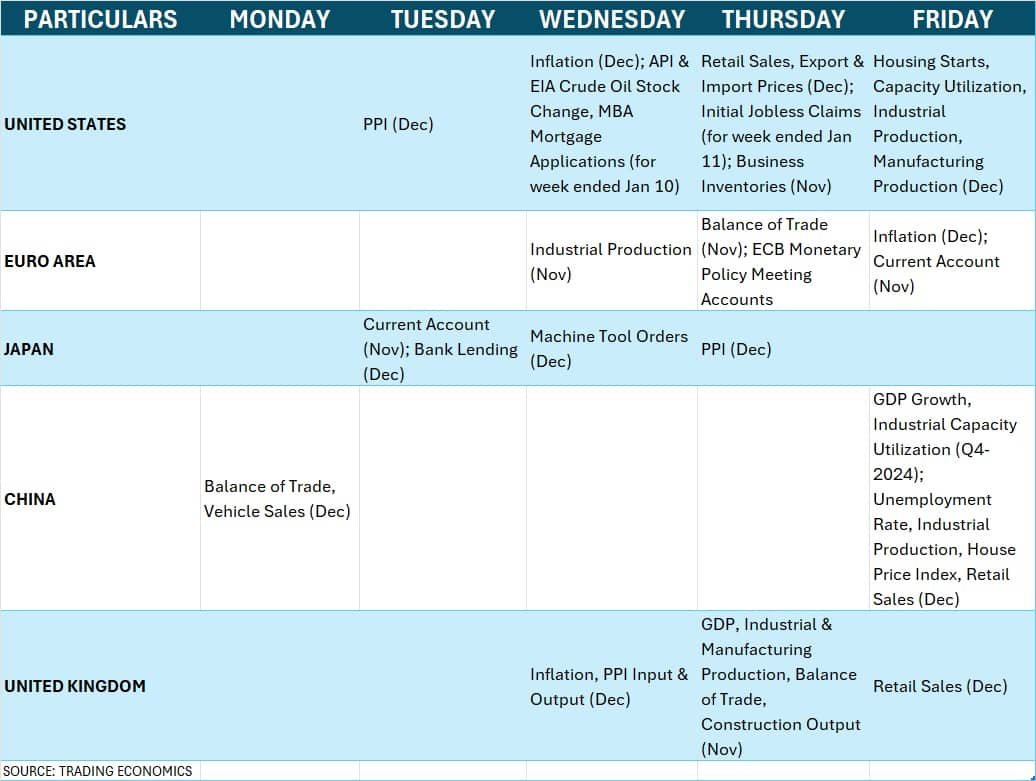

On the global front, all eyes will be on US inflation data. Global economists see a modest increase in inflation data in December. Core inflation is expected to remain stable at 3.3 percent. Additionally, PPI, retail sales, housing construction, industrial production data and weekly employment data for December will also be monitored.

FPI selling not stopping, ₹22194 crore withdrawn from shares so far in January

China’s GDP and other global economic data

China’s GDP numbers for the October-December quarter of 2024 will also be closely watched. Analysts believe it is likely to be around 5 percent. In addition, inflation data from Europe and the United Kingdom and vehicle and retail sales data from China will also be taken into consideration.

FII flows and rupee

Foreign institutional investors (FIIs) remained net sellers last week. On a temporary basis, they sold Rs 16,854 crore in the cash segment. Their outflow for the current month of January was Rs 21,357 crore due to high valuations. However, domestic institutional investors (DIIs) fully offset FII withdrawals and bought shares worth Rs 21,683 crore last week. DIIs have bought shares worth Rs 24,216 crore so far in January.

The Indian Rupee hit a new low of 86.1450 (which was also a closing level) against the US Dollar. Rupee weakened 0.47 per cent during the week due to correction in domestic markets, selling by FIIs, strong US dollar and rising oil prices.

oil prices

Global investors will also focus on oil prices, which rose for the third consecutive week after the US announced sanctions on the Russian oil industry. Cold weather in the US and Europe and expectations of increased oil consumption in China during the Lunar New Year also boosted prices. Experts expect oil prices to remain supported in the near term as the market worries that tough US sanctions on Russia could impact its crude oil exports to Asia. Brent crude futures, the international benchmark for oil prices, rose 4.25 percent during the week to $79.76 a barrel.

Laxmi Dental IPO will open on January 13 in the new starting week. Kabra Jewels IPO, Rikhav Securities IPO will open on January 15. After this, Land Immigration IPO will open on 16 January and EMA Partners IPO will open on 17 January. Talking about listing, on January 13, shares of Standard Glass Lining will be listed on NSE, BSE and shares of Indobell Insulation will be listed on BSE SME. Quadrant Future Tek IPO and Capital Infra Trust Invit will be listed on BSE and NSE on January 14. On the same day, Delta Autocorp IPO will be listed on NSE SME and Avax Apparels And Ornaments IPO, BRGoyal IPO on BSE SME. The shares of Sat Kartar Shopping will be listed on NSE SME on January 17.

m-cap of 5 out of top 10 companies reduced by ₹1.85 lakh crore, HDFC Bank suffered the biggest loss

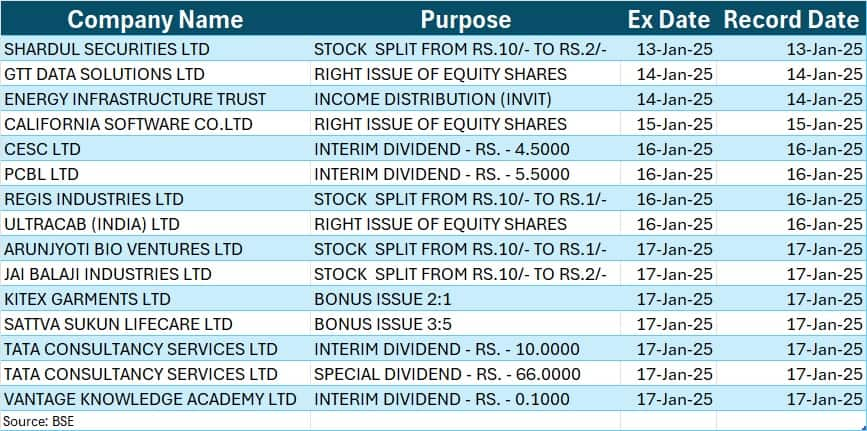

corporate actions

Here are the key corporate actions of next week…