Market Trade setup : Nifty broke the process of decline of two days and started a good start on July 21 with a gain of 0.50 per cent. However, the index is still trading below the short-term moving averages (10-Day and 20-Day EMA) and the order of the lower top-loar bottom continues. Until the Nifty regains the resistance zone of 25,200-25,250, it can continue to trade in a limited range with support at 24,900. The index can fall to 24,700 when going below this support. Experts also believe that if the Nifty goes above the resistance zone, it will be important to keep an eye on 25,400.

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and registration level for nifty

Support based on Pivot Point: 24,941, 24,887 and 24,799

Registration based on Pivot Point: 25,116, 25,170 and 25,257

Bank nifty

Registration based on pivot points: 57,009, 57,180 and 57,458

Support based on pivot points: 56,453, 56,281 and 56,003

Registration based on Fibonacci Retress: 57,050, 57,566

Fibonacci Retress based support: 56,389, 56,096

Nifty call option data

A maximum call of 79.19 lakh contracts has been seen open interest on a strike of 25,500 on the monthly basis, which will work as an important registration level in the upcoming business sessions.

Nifty put option data

A maximum of 79.67 lakh contracts have been seen open interest on a strike of 25,000, which will work as important support level in the coming business sessions.

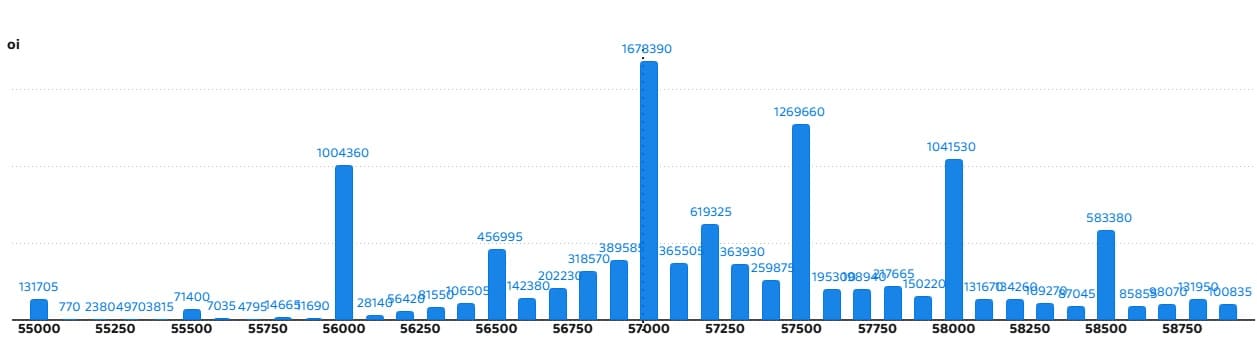

Bank Nifty Call Option Data

Bank Nifty has seen a maximum call open interest of 16.78 lakh contracts on a strike of 57,000, which will work as important registration levels in the coming business sessions.

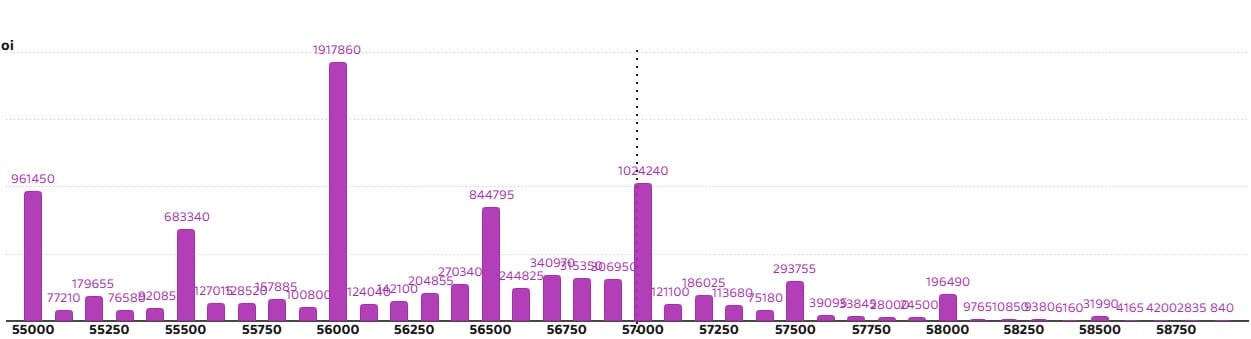

Bank Nifty put option data

On a strike of 56,000, a maximum put of 19.17 lakh contracts has been seen open interest which will work as important registration levels in the coming business sessions ahead.

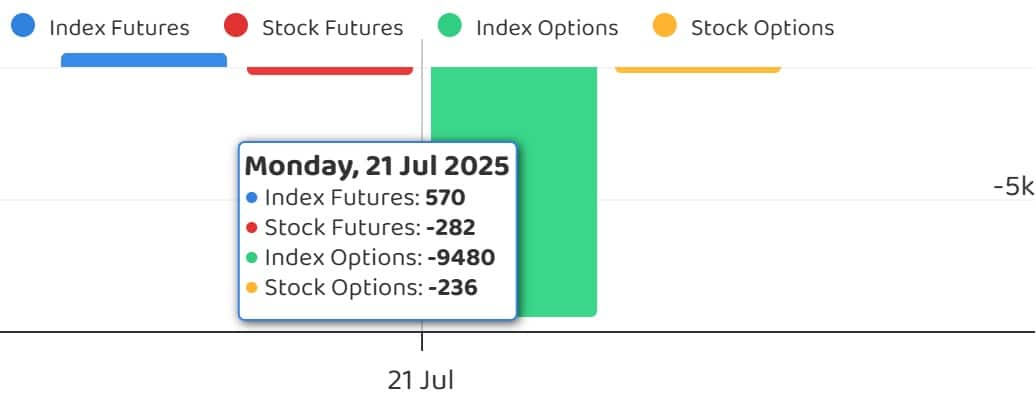

FII and DII Fund Flow

India VIX measuring the market’s possible volatility remained at a lower level and fell 1.67 per cent to 11.20. This is a sign of market stability. But traders should be cautious about market fluctuations, because volatility may increase rapidly.

High delivery trade

Here are the stocks given in which the largest part of the delivery trade was seen. The large part of delivery reflects the interest of investors (unlike trading) in stock.

Long build-ups shown in 54 stocks

Along with the increase in open interest, the rise in prices is also usually estimated to become a long position. Long build-ups were seen in 54 shares on the previous business day based on Open Interest Future Percentage.

Long Unwinding seen in 33 Stocks

Along with the fall in open interest, the fall in prices is also usually gauged by long disagreement. Based on the Open Interest Future Percentage, 33 shares saw the highest long long long -liveding in 33 shares.

Short build-up shown in 45 stocks

Along with the increase in open interest, the decline in prices is also usually gauged by short build-up. Based on the Open Interest Future Percentage, 45 shares were seen to have the highest short build-up.

Short covering in 94 stocks

Short covering is usually estimated by the rise in open interest as well as the rise in prices. Based on the Open Interest Future Percentage, 94 shares saw the highest short covering in 94 shares.

Call call ratio

The Nifty Put-Call Ratio, which depicted the market mood, rose to 0.96 on July 21, while it was at 0.78 levels in the previous session. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stocks involved in F&O ban: nobody

Stocks already involved in F&O ban: Bandhan Bank, RBL Bank

Stocks removed from F&O ban: Angel One, Hindustan Copper

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.