In a move that may further make credit card usage costlier, the State Bank of India has revised certain charges for its credit card users. The new charges will come into effect from November 15. So, the charges won’t be applicable on transactions done before November 15. The SBI in a message sent to its customers, said, “Dear Cardholder, charges on your credit card shall be revised/levied w.e.f. from 15 Nov’22,” and asked its customers to visit the website for further details.

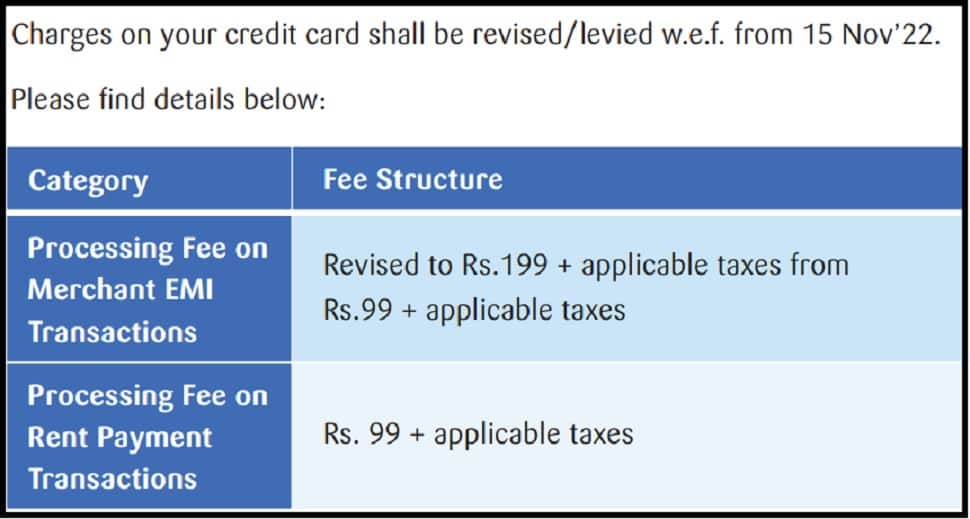

While the SBI has revised charges on EMI transactions, it has levied a new charge on rent payments using credit cards. “Charges on your credit card shall be revised/levied w.e.f. from 15 Nov’22. The processing fee on merchant EMI transactions has been revised to Rs 199 + applicable taxes from earlier Rs 99 + applicable taxes. Processing fee on rent payment transactions will be Rs 99 + applicable taxes,” said the bank.

However, it’s not yet clear if the transaction was done before November 15 and the billing cycle is after November 15, then whether the new rates will apply to those transactions.

With this, the SBI have become the second bank to levy a processing fee on rent payments using credit cards. Earlier, the ICICI Bank had said that it would charge its credit card holders a one per cent fee towards rent payments with effect from October 20.

There are various third-party platforms like RedGiraffe, Mygate, Cred, Paytm and Magicbricks that allow users (tenants) to pay rent using their credit cards. However, they charge a certain service fee in lieu of this. All the users have to do is input their credit card details on the platform, then go to the rent payment option and fill in the details like name, bank account number, IFSC code or add the UPI (Unified Payments Interface) address of the landlord and then make the desired payment.